IE 525 (Stochastic Calculus)

Section A

CRN 54714

This syllabus governs the first half of the course (January 25-March 15); Professor Liming Feng will be the instructor for the second half.

- Instructor: Richard Sowers <r-sowers@illinois.edu>

- Home page: https://publish.illinois.edu/r-sowers/ (this syllabus can be found there).

- TA: Qi Zhao <qiz2@illinois.edu>

- Class meets: 9:30AM – 10:50AM MW on Zoom (see compass2g) January 25-March 15

- Class Page: on Google Drive

- Texts (optional):

- Logistics: Compass2g and Piazza

- Safety information: http://police.illinois.edu/emergency-preparedness/run-hide-fight/resources-for-instructors/

Topics:

- Pairs Trading (1/3 week)

- Gaussian random variables (1/3 week)

- Central Limit Theorem (1/3 week)

- Brownian Motion (1 week)

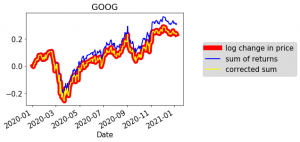

- Returns and Log Returns (1/3 week)

- Information (1 week)

- Brownian Quadratic Variation (1/3 week)

- Ito Integration (1.5 weeks)

- Ito Formula (1.5 weeks)

Grading policy: Final grades for the first half of the semester will be determined on the basis of the total numerical score (and will be curved).

| Component | Weight | |

| Hourly Exam (2/22) | 25% of grade | |

| Hourly Exam (3/15) | 25% of grade | |

| Quizzes, Projects, Homework | 50% of grade |

Logistical notes:

-

- Videos will be available on Illini Media Space:

- Asynchronous lectures will be made available in advance.

- Synchronous lectures will be made available soon after the lectures.

- We will observe the Spring 2021 semester non-instructional days: Wed-February 17th, Wed-March 24th, Tues-April 13th

- There will be a number of assignments involving data (and coding). Python (and Jupyter notebooks) will be the preferred framework for this (Python is one of the top languages for data analysis, so this is designed to be to your benefit). NB: Anaconda is one of the common distributions of Python.

- We will extensively use Google Drive and Google Colab and for teaching material and submission of coding projects. To get access to these, you need to have Account Status “On” for Google Apps at https://cloud-dashboard.illinois.edu/cbdash/ and then log in via g.illinois.edu

- Coding HW must be submitted by sending the TA’s a link to a Google Colab notebook (and giving the TA’s viewing permission).

- Several assignments will be group projects, with 4 people being the optimum group number. A “Groupness extra credit” will be added to each assignment, with the value of

- 3 if your group has 4 members

- 2 if your group has 3 or 5 members

- 1 if your group has 2 members

- 0 in all other circumstances.

- I will give extra credit points for co-hosting office hours (as a means of increasing involvement in the class)

- All date-times will be in Champaign-Urbana.

- All students are expected to abide by the Honor Code; you are here to learn (and my interest is in helping you do that).

- The technology of the course may evolve as the semester progresses and as I learn new tools. The content and goals will stay the same.

- Students who have suppressed their directory information pursuant to the Family Educational Rights and Privacy Act (FERPA) should self-identify to the instructor.

- Videos will be available on Illini Media Space: